/

/

IMF Releases Stablecoin Report

IMF Releases Stablecoin Report And Gives Outlook. Photo By Daniel Esteves On Unsplash.

The International Monetary Fund (IMF) has released a stablecoin-related paper.

IMF Highlights How Stablecoins Work, Key Trends And Risks

The publication called 'Understanding Stablecoins' prepared by a large team of contributors at IMF has attempted to give a holistic overview of how stablecoins work, the inherent risks associated, as well as the trajectory of current and future stablecoin impact.

Here are the key trends and points to note from their executive summary:

The large majority of currently existing stablecoins is denominated in United States dollars.

Stablecoins could increase efficiency in payments - pariticularly cross-border transactions, including by reducing the costs and enhancing the speed of remittances.

Stablecoins value can fluctuate due to the market and liquidity risks of their reserve assets.

Stablecoins may contribute to currency substitution, increase capital controls, and fragment payment systems unless interoperability is ensured.

Many authorities have started implementing international standards for stablecoins, but the landscape remains fragmented.

The report is certainly more geared towards fully breaking down the inherent risk of fiat-backed stablecoins, with a large focus on the mitigation of technical, sovereign and institutional risks. More specifically, within this critique was a useful mention of the fragmented regulatory guidance and back-end design on reserve holdings and redemption procedures in some but not all of the jurisdictions, including the U.S, UK, EU, and Japan (page 41).

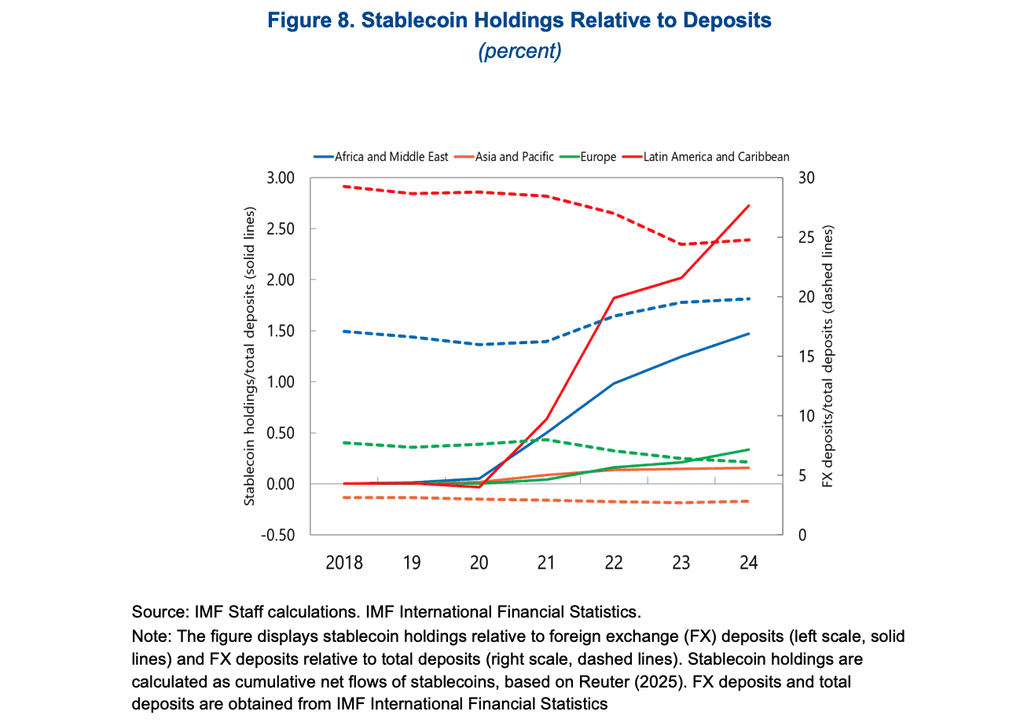

Figure 8. Stablecoin Holdings Relative to Deposits (IMF, Understanding Stablecoins, 2025).

In nearly all regions mentioned (Africa and Middle East; Asia and Pacific; Europe; Latin America and Caribbean) there is an underlying increased rate of adoption as stablecoins continue to chase the larger FX/total deposit ratio.

READ THIS FROM WHEREVER YOU ARE.

By signing up, you agree to our Privacy Policy

Note: This is intended for informational purposes only and does not in any way constitute or solicit financial, professional, or legal advice. Readers should conduct their own due diligence at all times.

Certain pages may have disclaimers above to distinguish between submitted press releases, AI-assisted and sponsored content, as well as Stablecoin News exclusives. Sources used are shown below.