/

/

Barclays Backs Ubyx, The Stablecoin Company Solving Clearing

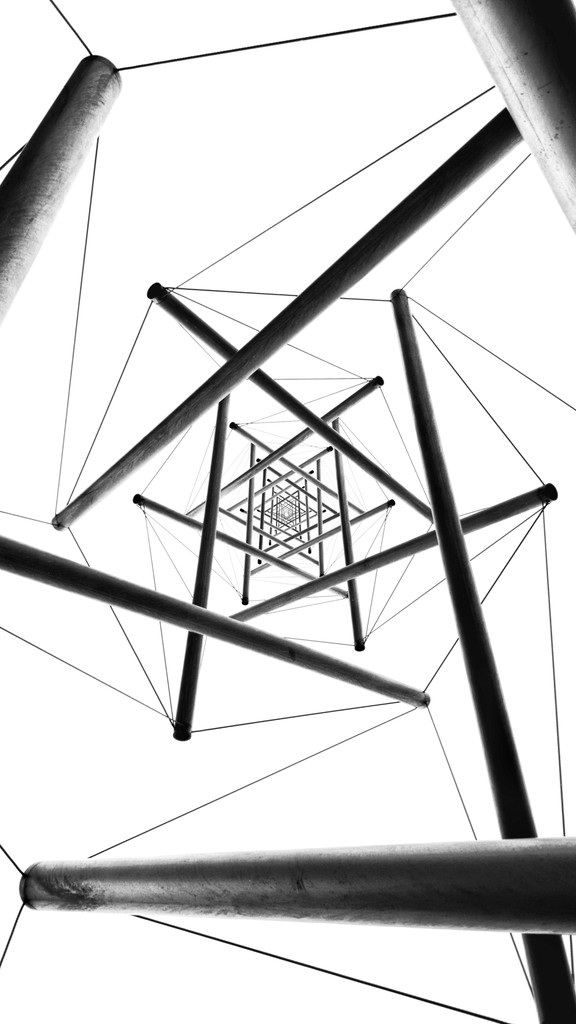

Barclays Backs Ubyx, The Stablecoin Company Solving Clearing. Photo By Dhruv Weaver On Unsplash.

Barclays has officially invested in Ubyx to help solve stablecoin clearing.

Ubyx has revealed the latest round of funding (undisclosed amount) to scale their efforts on managing the final orchestration between issuers, banks, PSPs and others to create a universal stablecoin clearinghouse network.

This will be primarily tracking and delivering on the stablecoin redemptions, with a strong emphasis on "at par value". While most focus on the front-end rails, their team is targeting a much larger global operation (detailed diagrams can be found in the Ubyx Whitepaper).

Tony (CEO and Founder) expressed:

Our mission is to build a common globalised acceptance network for regulated digital money including tokenised deposits and regulated stablecoins. Bank participation is vital to provide par value redemption through regulated channels. We are entering a world in which every regulated firm offers digital wallets in addition to traditional bank accounts."

With a reliable central stablecoin clearing system in place, this makes it easier for various international counterparties and depositories to start integrating blockchain technology for high volume transactions, especially for banks and broker dealers.

This is a market that requires a great deal of cooperation or "ubiquity" and is also expected to grow substantially over the next few years (see Ken Research).

READ THIS FROM WHEREVER YOU ARE.

By signing up, you agree to our Privacy Policy

Note: This is intended for informational purposes only and does not in any way constitute or solicit financial, professional, or legal advice. Readers should conduct their own due diligence at all times.

Certain pages may have disclaimers above to distinguish between submitted press releases, AI-assisted and sponsored content, as well as Stablecoin News exclusives. Sources used are shown below.